According to Statista, the predictive analytics market is projected to hit $41.52 billion by 2028. That’s not just growth. Absolutely, The future of finance isn’t just about managing numbers. It’s about predicting them.

In this article, we understand the importance of Predictive analytics in Finance & Banking Industry along with its real word use cases for better understanding.

Predictive Analytics in Finance Industry?

By combining smart tech like AI, machine learning, and advanced statistics, predictive analytics helps finance teams go beyond just “what happened” and start answering “what’s going to happen?”

Instead of digging through endless data manually, these advance tools spot trends and patterns for you, giving you a leg up when it comes to forecasting cash flow, managing risk, or planning your next investment.

Take accounts receivable, for example. Predictive analytics in Finance models can help you figure out which customers might pay late, who’s a credit risk, and even suggest the likely day a payment will come through. That’s not guesswork. It’s an insight you can act on.

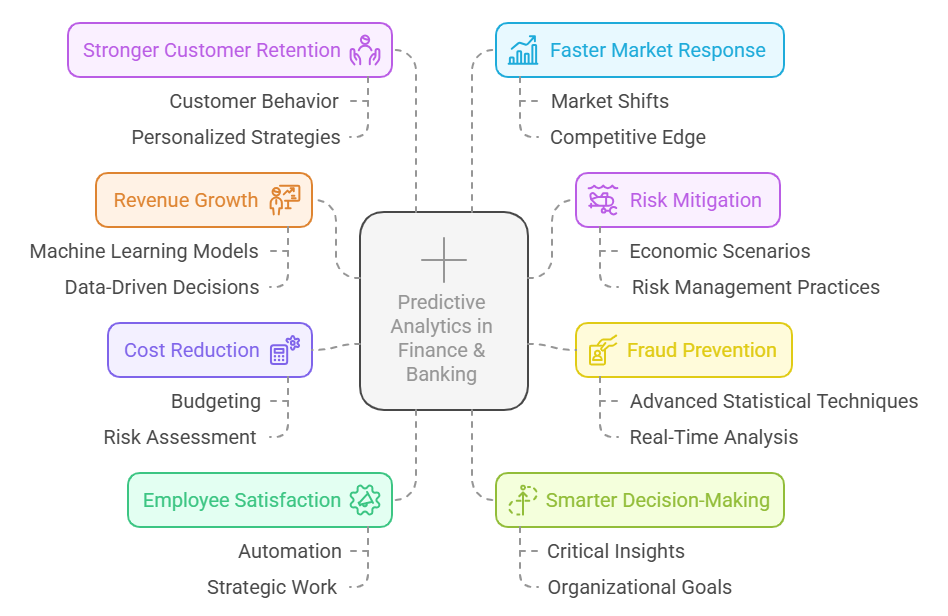

Importance of Predictive Analytics in Finance & Banking?

Predictive analytics in Finance is transforming the financial landscape by enabling smarter decision-making, reducing risk exposure, and boosting cost-efficiency.

Below are eight keyways predictive analytics is helping finance professionals stay ahead of the curve.

- Revenue Growth: Machine learning-powered predictive models enable investment professionals to make informed, data-driven decisions. This leads to more effective market strategies and contributes to higher revenue generation for financial institutions.

- Risk Mitigation: Predictive analytics provides financial institutions with the ability to simulate various economic scenarios and make decisions based on reliable data. This approach strengthens risk management practices and reduces exposure to potential threats.

- Fraud Prevention: By applying machine learning and advanced statistical techniques, organizations can analyze large volumes of data in real time. This significantly enhances the accuracy of fraud detection and helps prevent financial misconduct.

- Cost Reduction: Incorporating predictive analytics into budgeting and risk assessment gives financial organizations deeper visibility into daily cash flow patterns. This insight supports more efficient resource allocation and drives overall cost savings.

- Employee Satisfaction: By automating repetitive and time-consuming tasks, predictive analytics allows employees to focus on more meaningful and strategic work. This not only increases productivity but also contributes to greater job satisfaction and engagement.

- Smarter Decision-Making: Predictive analytics delivers critical insights that support well-informed, strategic decisions. It helps align financial planning with broader organizational goals, evolving market conditions, and changing customer expectations.

- Stronger Customer Retention: Understanding customer behavior and anticipating their needs enables financial institutions to create personalized retention strategies. This proactive approach reduces churn and helps build lasting, loyal relationships.

- Faster Market Response: With predictive analytics, financial firms can better anticipate shifts in the market and respond quickly to change. This adaptability gives them a competitive edge and allows them to seize opportunities as they arise.

Predictive Analytics in Finance & Banking: Use Cases

Predictive analytics is used across a wide range of industries, but in the financial sector, it plays a particularly valuable role. It helps finance teams improve visibility into cash flow, manage credit risk more effectively, and optimize overall financial performance. Let’s explore some real-world use cases predictive analytics in Finance & Banking industry.

Revenue and Cash Flow Forecasting

Predictive analytics helps finance teams forecast cash inflows and outflows by analyzing invoice data, historical payment trends, and current cash positions. Tools like Microsoft Power BI, integrates with Dynamics 365 Finance, enable real-time financial reporting and forecasting dashboards. These insights help finance teams plan investments more effectively, segment customers based on payment behavior, and optimize cash flow management.

Customer Payment Predictions

Using predictive models, finance professionals can evaluate the likelihood of customers paying on time, making partial payments, or missing deadlines. Azure Machine Learning can be used to build and train models based on historical payment data, credit history, and external financial indicators. These insights allow collection teams to prioritize follow-ups and tailor communications to each customer’s risk profile.

Fraud Detection and Risk Management

Spending on credit and technology introduces risk, but predictive analytics helps mitigate it by identifying anomalies and suspicious patterns. Microsoft Sentinel and

Azure AI

services can monitor transactions in real time, flag potential fraud, and evaluate risk exposure across departments. These tools enhance financial oversight and help prevent costly errors or misconduct.

Credit Risk Management

Predictive analytics strengthens credit risk evaluation by incorporating credit reports, behavioral data, and market indicators. With Dynamics 365 Finance and Azure Synapse Analytics, companies can create real-time credit scoring models and automatically flag potential blocked orders based on customer payment behavior and credit utilization. This enables smarter, faster decision-making when extending credit

.

Budgeting and Resource Allocation

By analyzing historical trends and financial patterns, predictive analytics supports more accurate budgeting and optimal resource distribution. Excel with Power BI integration allows finance teams to model multiple scenarios and visualize the projected impact of budget decisions. These insights help reduce wasteful spending and ensure funds are allocated where they will have the greatest return.

Accounts Receivable Analytics for Working Capital Management

Predictive analytics in accounts receivable offers clear visibility into aging invoices, overdue payments, and trends that affect working capital. Dynamics 365 Finance and Power BI dashboards provide intuitive visualizations of receivables, helping categorize accounts and forecast expected cash flow. This allows finance teams to take timely action and maintain a healthy cash position.

Wrapping It Up

Predictive analytics is financial sector is far from being a passing trend, it has become essential. Its influence spans everything from risk assessment to delivering personalized insights for customers. Integrating AI-driven predictive analytics into your operations opens the door to new possibilities. It boosts efficiency, simplifies workflows, and strengthens decision-making. By adopting AI in financial analytics, businesses can successfully update and enhance outdated systems.

As finance industry continues to evolve, data is becoming the driving force behind progress. To remain competitive, adopting predictive analytics is key. Intelegain technologies leads this innovation, providing advanced AI and analytics solutions that help financial institutions unlock the true value of their data. With the right technology partner , you can build a future-ready financial strategy and accelerate innovation across your organization.

FAQs

The key components of predictive analytics are data collection, data processing, and predictive modeling. Together, these elements serve as the foundation for producing accurate and actionable insights.

Regression analysis is the most frequently applied method in predictive analytics. It helps forecast numerical results by analyzing the relationships between different variables.

It identifies unusual patterns and flags suspicious transactions in real time, helping banks detect and prevent fraud early.

Yes, it assesses credit risk more accurately, enabling faster and more reliable loan decision-making.

Wondering how predictive analytics can boost your finance business? Book a FREE consultation!

We've empowered hundreds of clients to maximise their business growth online.